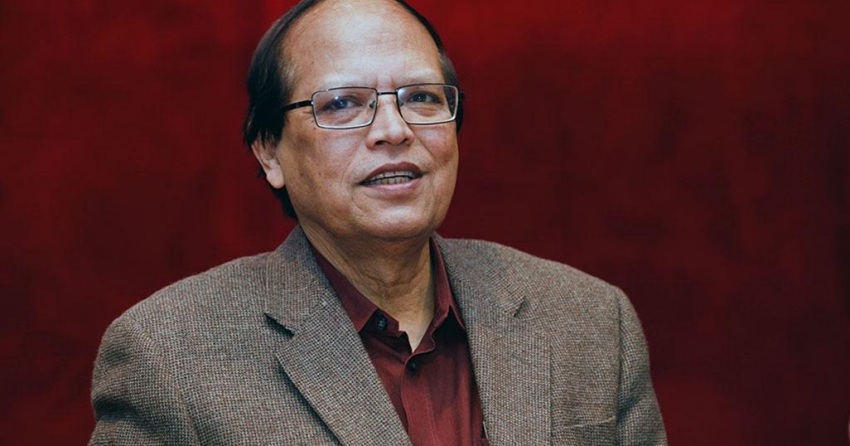

Bangladesh Bank (BB) Governor Ahsan H Mansur on Saturday said that Bangladesh’s financial sector is making tangible progress in macroeconomic stability, external sector management and governance reforms despite deep-rooted structural challenges.

Mansur made the remarks while addressing the “Fourth Bangladesh Economic Conference: Future Roadmap of Economy and Political Pledge” held at a hotel in the capital.

Daily Bonik Barta organised this conference.

The BB governor said that the exchange rate has been successfully stabilised a prerequisite for bringing down inflation.

Since he assumed office, Mansur said the exchange rate has remained broadly stable, moving from Tk120 to Tk 122.50 per US dollar, while major regional currencies have seen larger depreciations.

No intervention is currently required in the foreign exchange market, as supply and demand are determining the rate, he noted.

Mansur said foreign banks that previously reduced exposure to Bangladesh have restored normal operations, while the earlier backlog in external payment arrears has been fully cleared.

The current account deficit has narrowed significantly and the financial account has turned slightly positive.

“Our external sector is stable and not vulnerable,” he said, adding that banks now face no dollar shortage and all margin requirements for imports have been withdrawn.

Import of LCs for essential Ramadan commodities have already been opened, in some cases 20% higher than the previous year side by side import volumes through Chattogram Port were at record levels in the last fiscal year and have continued to grow in double digits this year, he informed.

Despite these improvements, the central bank governor stressed that high non-performing loans remain a major obstacle.

“With new classification rules and updated data, the NPL ratio may stand around 35%. This is a major challenge and will take five to 10 years to resolve,” he noted.

He said interest rates remain high because inflation has yet to fall to the desired level.

Mansur said deposit rates have already increased to around 10% and may rise further to ensure positive real returns.

He also highlighted the pressure created by high government borrowings from the banking system.

Reporter Name

Reporter Name